I have been thinking about this for quite some time and would like to hear some other opinions on it. While Puerto Rico is in the midst of major economic woes, there seems to be a rather strange phenomenon going on with what are called Acts 20 and 22 as well as 273. I have heard of these things enough to warrant looking into it some.

Here are the details I found:

These are laws that passed in 2012 with the intent of bringing in investors, money and jobs to the island. Here are some key benefits to investors for each of them.

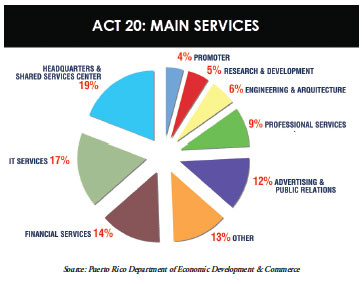

Act 20: Create export services by alluring outside service entities via tax incentives to relocate to the island

0% Taxes on Earnings and Profit

3-4% Flat Income Tax

0% Property Tax

Act 22: Entice nonresident investors to relocate in Puerto Rico

0% Taxes on Dividends and Interest

0%-10% Taxes on Capital Gains

Act 273: Broaden the scope of banking activities for international financial entities (IFEs)

4% Income Tax on Permitted IFE Activities

0% Property Tax on Real, personal, tangible, and intangible property

IFE Shareholder incentives:

6% Income Tax on Distributions for P.R. residents

0% income Tax on Distributions for non-residents

Basically what this amounts to are some major tax breaks on everything from property, corporate taxes, individual taxes and banking to non-residents of Puerto Rico if they live here for at least half the year. The hope, of course, is that this luring in of investors and businesses to the island would help improve the economy by providing jobs, spending money and improving the island’s infrastructure by buying up old run down assets. But as you may notice, glaringly, these Acts don’t even apply to Puerto Ricans! For Act 22 for example, you are only eligible if you hadn’t lived in Puerto Rico between 1997 and 2012! Why is there no emphasis on building up businesses from within or at least extending the same benefits? These are so obviously geared at outside interests it’s just downright weird.

So given all of that, what’s the verdict? Are these actually working? Does lowering taxes on the wealthy and bringing in wealthy non-residents improve an economy? Well, these laws were written so hastily that while they know that a few hundred people have come to start investments or businesses here in the last 3 years under these acts, they don’t know what the true impact has been and are just going to start studying the impact now. Oh geez, let’s just write a law and THEN hope that it works? Fingers crossed!

But they already know. In general most progressive economists say no, that lowering taxes on the wealthy doesn’t actually improve an economy. What it does is make the rich richer and widen the gap between wealthy and poor. And in this case, it seems to also divide the outside interests and local Puerto Rican interests since there is not an equal playing field. The haves and the have-nots are further entrenched. Trickle down economics has been tried and just doesn’t work.

The basis for a stable economy has always been a strong middle class and these types of tax breaks don’t build up the middle class -especially when it is not available to the general public, you know, to Puerto Ricans! I know quite a few people who would love to take part in these programs but can’t because they were already living here! How backwards is that?! Let’s bring in outside interests that know nothing of the island rather than spurring growth from within of people who know they already love it and don’t want to leave!

In the last 3 years there has been little sign that these sorts of programs have worked at all to help Puerto Rico. The situation in Puerto Rico is even more severe because with so many people leaving the island in search of economic opportunities elsewhere these laws have brought on a type of money grab akin to Detroit by people like John Paulson and Nicolas Prouty who have bought up not only Puerto Rico debt but also huge swaths of property making it even more difficult for local Puerto Rico investments into the community. The whole thing seems to be like building an economy on a house of cards and the stakes just get higher.

And what makes this even more appalling to me is that at the same time that the uber wealthy are swooping in on Puerto Rico, the Puerto Rican people who can’t take advantage of these benefits are suffering through austerity measures including high sales taxes, high costs of goods and services (partially due to outdated shipping rules) and shutting down local schools and hospitals all the while being treated as second class citizens without the same rights (voting, bankruptcy) as elsewhere in the states.

These types of tax incentives for the wealthy have been tried before (here’s a long report on the economic history of PR) and brought the large pharmaceutical and other manufacturing companies years ago. But there were no real roots tying these businesses to Puerto Rico. Once the tax benefits expired, the businesses packed up and left. This disrupted so much of society as it took people from the countryside who had worked traditionally on the land and put them in the cities and factories. Once the companies left, the people with no other options were left holding the bag. It seems the same pattern is happening again. It’s a hedge fund party in a economic crisis and the true cost is paid by the locals. The environment is doubly regressive: taxing the poor through higher and higher sales and other taxes and not collecting the fair share from the corporations and individuals that have capitalized on the island -and who are certainly not suffering financially. The financial inequality and disparity only widens.

I have actually met some of the people who have come to Puerto Rico primarily because of these Acts and I understand it from their perspective. They are mainly good people just going where the incentives have led them. They may even truly want to help Puerto Rico. It is not the people I have a problem with and I encourage people to come here who truly want to stay and help Puerto Rico! But I do have a problem with bad policy. And these Acts are bad. They are not holistic, not available and encouraged for local populations, have not been shown to have a real positive impact, do nothing to address the economic burdens that are created, and they are just simply unfair and divisive! They do not bring equal opportunities for all and in fact widen the disparity! Because while these incentives have worked to bring people here, I am not sure it has worked to get them to stay and help the island in a long or sustainable way. If they ever actually make that report that studies the impact of these laws I would love to see how many of these investors stay on the island for more than the 183 day minimum and consider Puerto Rico truly their “home” in anything other than name.

So that’s where my investigations have taken me on Acts 20/22/273. Perhaps in a generally healthy economy, they could stand up to some scrutiny and if they were geared at actually encouraging Puerto Rico ingenuity and entrepreneurship -or bringing back the diaspora of Puerto Ricans from the states even!- I might be able to stand behind them. As they are currently, though, they seem to be just more of the same wealthy elites writing the rules for the rich to get richer on a beautiful tropical island playground for half a year at a time while ignoring the true community and local interests.