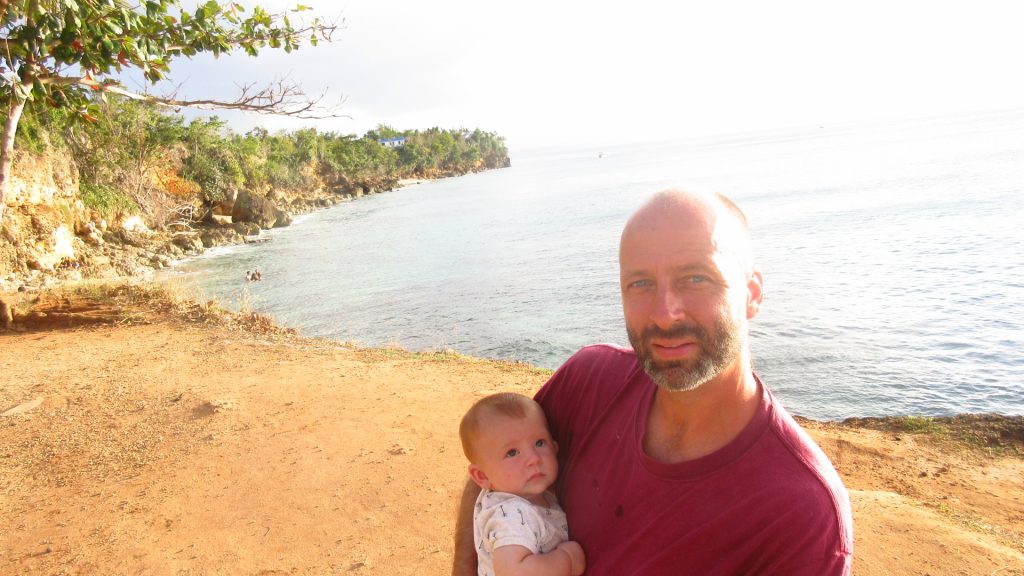

If you’ve been following this blog for any time, you know that we retired young and moved to the Caribbean to live the life of our dreams. Some people have made the comment to us that it is all fine and dandy to do that as a single person or couple, but it is altogether different with kids. And that is somewhat true. Having a child changes a lot about your life and realigns priorities quick. Children definitely don’t make things any cheaper.

However, I would say that it is completely feasible to live financially independent with kid(s). Being frugal and budget minded was what got us here and it certainly doesn’t (or shouldn’t) go away when you have kids. If you have good financial habits you just sort of incorporate them into the new life with child. Here are a few tips and tricks we have learned so far in our journey as frugal parents.

Hand-me-downs!

Baby stuff only lasts a short while. Take any offer of hand-me-downs that you can get, whether as a gift or bought secondhand. Many times they are only 3-6 months old and in great shape. We have a hand-me-down crib, breast pump, carriers and lots and lots of clothes and toys among other things. The only thing we have bought new was a dresser/changing table.

Breast feeding

Breastfeeding is not as easy as it looks and can even be painful (as it was for me in the beginning), so I completely sympathize with moms who aren’t able to do it, or do it for long. But it really is the best gift you can give your baby to start them out: from a strong immune system to parental/child bonding, it is an amazing thing. But the added bonus is that it is free! If you added up how much we would be spending on formula we have probably already saved hundreds of dollars.

Diapers

I really wish I could say that I use the reusable diapers we were given more than I do. We don’t have a washer and dryer near the house (actually we don’t have a dryer at all), so cleaning diapers would be a huge chore. That said, they are a great money-saving and environmentally friendly option and we have used them some. The good thing about disposables, however, is that you don’t have to change them very often because they can soak up a LOT of liquid, so one diaper often lasts through a whole night and you don’t need to worry about diaper rash as much. We were gifted a huge pack of diapers when Aeden was born and have only recently gone through them. I estimate we will need to spend about $40/month on them until he’s ready to be potty trained (around 2 years old).

Healthcare

Thankfully here in Puerto Rico health care and insurance isn’t too expensive. To have our baby covered by health insurance is about $90/month and has very low co-pays ($10/doctor visit).

So all in all our expenses have increased about $150/month since having our baby which isn’t too bad! Since we are both home we can do things to increase our income (like selling flowers, renting out the cabana, etc) and take turns watching the child. Babies really don’t need much. They just need to be fed, cleaned and loved. And that, my friends, is priceless.