I have been thinking about this for quite some time and would like to hear some other opinions on it. While Puerto Rico is in the midst of major economic woes, there seems to be a rather strange phenomenon going on with what are called Acts 20 and 22 as well as 273. I have heard of these things enough to warrant looking into it some.

Here are the details I found:

These are laws that passed in 2012 with the intent of bringing in investors, money and jobs to the island. Here are some key benefits to investors for each of them.

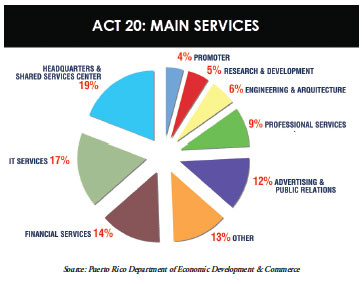

Act 20: Create export services by alluring outside service entities via tax incentives to relocate to the island

0% Taxes on Earnings and Profit

3-4% Flat Income Tax

0% Property Tax

Act 22: Entice nonresident investors to relocate in Puerto Rico

0% Taxes on Dividends and Interest

0%-10% Taxes on Capital Gains

Act 273: Broaden the scope of banking activities for international financial entities (IFEs)

4% Income Tax on Permitted IFE Activities

0% Property Tax on Real, personal, tangible, and intangible property

IFE Shareholder incentives:

6% Income Tax on Distributions for P.R. residents

0% income Tax on Distributions for non-residents

Basically what this amounts to are some major tax breaks on everything from property, corporate taxes, individual taxes and banking to non-residents of Puerto Rico if they live here for at least half the year. The hope, of course, is that this luring in of investors and businesses to the island would help improve the economy by providing jobs, spending money and improving the island’s infrastructure by buying up old run down assets. But as you may notice, glaringly, these Acts don’t even apply to Puerto Ricans! For Act 22 for example, you are only eligible if you hadn’t lived in Puerto Rico between 1997 and 2012! Why is there no emphasis on building up businesses from within or at least extending the same benefits? These are so obviously geared at outside interests it’s just downright weird.

So given all of that, what’s the verdict? Are these actually working? Does lowering taxes on the wealthy and bringing in wealthy non-residents improve an economy? Well, these laws were written so hastily that while they know that a few hundred people have come to start investments or businesses here in the last 3 years under these acts, they don’t know what the true impact has been and are just going to start studying the impact now. Oh geez, let’s just write a law and THEN hope that it works? Fingers crossed!

But they already know. In general most progressive economists say no, that lowering taxes on the wealthy doesn’t actually improve an economy. What it does is make the rich richer and widen the gap between wealthy and poor. And in this case, it seems to also divide the outside interests and local Puerto Rican interests since there is not an equal playing field. The haves and the have-nots are further entrenched. Trickle down economics has been tried and just doesn’t work.

The basis for a stable economy has always been a strong middle class and these types of tax breaks don’t build up the middle class -especially when it is not available to the general public, you know, to Puerto Ricans! I know quite a few people who would love to take part in these programs but can’t because they were already living here! How backwards is that?! Let’s bring in outside interests that know nothing of the island rather than spurring growth from within of people who know they already love it and don’t want to leave!

In the last 3 years there has been little sign that these sorts of programs have worked at all to help Puerto Rico. The situation in Puerto Rico is even more severe because with so many people leaving the island in search of economic opportunities elsewhere these laws have brought on a type of money grab akin to Detroit by people like John Paulson and Nicolas Prouty who have bought up not only Puerto Rico debt but also huge swaths of property making it even more difficult for local Puerto Rico investments into the community. The whole thing seems to be like building an economy on a house of cards and the stakes just get higher.

And what makes this even more appalling to me is that at the same time that the uber wealthy are swooping in on Puerto Rico, the Puerto Rican people who can’t take advantage of these benefits are suffering through austerity measures including high sales taxes, high costs of goods and services (partially due to outdated shipping rules) and shutting down local schools and hospitals all the while being treated as second class citizens without the same rights (voting, bankruptcy) as elsewhere in the states.

These types of tax incentives for the wealthy have been tried before (here’s a long report on the economic history of PR) and brought the large pharmaceutical and other manufacturing companies years ago. But there were no real roots tying these businesses to Puerto Rico. Once the tax benefits expired, the businesses packed up and left. This disrupted so much of society as it took people from the countryside who had worked traditionally on the land and put them in the cities and factories. Once the companies left, the people with no other options were left holding the bag. It seems the same pattern is happening again. It’s a hedge fund party in a economic crisis and the true cost is paid by the locals. The environment is doubly regressive: taxing the poor through higher and higher sales and other taxes and not collecting the fair share from the corporations and individuals that have capitalized on the island -and who are certainly not suffering financially. The financial inequality and disparity only widens.

I have actually met some of the people who have come to Puerto Rico primarily because of these Acts and I understand it from their perspective. They are mainly good people just going where the incentives have led them. They may even truly want to help Puerto Rico. It is not the people I have a problem with and I encourage people to come here who truly want to stay and help Puerto Rico! But I do have a problem with bad policy. And these Acts are bad. They are not holistic, not available and encouraged for local populations, have not been shown to have a real positive impact, do nothing to address the economic burdens that are created, and they are just simply unfair and divisive! They do not bring equal opportunities for all and in fact widen the disparity! Because while these incentives have worked to bring people here, I am not sure it has worked to get them to stay and help the island in a long or sustainable way. If they ever actually make that report that studies the impact of these laws I would love to see how many of these investors stay on the island for more than the 183 day minimum and consider Puerto Rico truly their “home” in anything other than name.

So that’s where my investigations have taken me on Acts 20/22/273. Perhaps in a generally healthy economy, they could stand up to some scrutiny and if they were geared at actually encouraging Puerto Rico ingenuity and entrepreneurship -or bringing back the diaspora of Puerto Ricans from the states even!- I might be able to stand behind them. As they are currently, though, they seem to be just more of the same wealthy elites writing the rules for the rich to get richer on a beautiful tropical island playground for half a year at a time while ignoring the true community and local interests.

To me the Acts 20 and 22 are a lot like dancing on a pole to feed your children. They’re desperate measures that are not particularly honorable but in the end you do whatever it takes to keep the lights on. I would have opposed these measures two decades ago because of all of the negative reasons that you mentioned but at a time when the local government is insolvent I can no longer pretend that the poor Puerto Ricans who’ve stayed (myself included) have the necessary means to bootstrap the local economy.

What you say about Reaganomics being BS I agree. But keep in mind that Puerto Rico, or anyone else in the western hemisphere, doesn’t have enough power to circumvent the massive power that the US exerts on the global economy. And you know what happens to the Latin American countries who don’t play nice within the economic framework that the US has established. Like George Carlin said, “The game is rigged”, and in the case of Puerto Rico perhaps doubly so because historically speaking no efforts were ever made by the Spanish or the Americans to create a self sustaining economy.

And no, I’m not trying to shift blame here. It’s a historical fact that the government and economy that we have today was created unilaterally by the Americans. And for the first 50 years of this relationship Puerto Ricans didn’t even get to vote for their own local government. And I don’t say these things as a U.S. hating Puerto Rican. Those who know me know that I’m a supporter of statehood.

There are other measures that I would take, for example, I would eliminate the unfair cabotage laws that make Puerto Rican exports non competitive. I would force the UPS and friends to treat Puerto Rico as a domestic entity. And I would stop US businesses from discriminating against Puerto Rican businesses. (That last one will hurt me in a few months if I release a product that I’m currently working on.) But as you already know we Puerto Ricans have no control whatsoever over any of these things. The most that we can do is send our one non voting representative to beg, which is what we’ve been doing for decades. But making Puerto Rico competitive wouldn’t benefit any of the US states that it would be competing against so yeah, we have no options left but to lower the wages and increase the taxes of the locals while reducing the taxes of foreign investors in the hopes that someone will throw some pocket change at us. But as you can expect, this puts the local government in debt and prevents a local middle class from forming which is exactly the problem that we’re dealing with. It’s an unwinnable situation.

And now, if you excuse me, I have to go because those G-Strings are not going to wash themselves.

We will be moving to PR in a few months with our small family, and I, for one, am ecstatic that these laws exist to help entice people to the island. We are not rich by any means. But I am self employed and these laws are going to allow us to live comfortably on the island. Without them, I don’t know that we would have decided to come due to financial constraints.

I think more needs to be done to help all income levels, not just the rich. But I also think a lot of the change has to come from the US mainland. Without support from them, there is little that the island can do to fix the massive income inequality that currently exists…

Those “acts” would drive me towards Statehood if I lived in P.R. The island is just a vassal of the U.S. with no rights and obviously supply side wealthy in charge of what little could be referred to as a “government”. State government can be corrupted also, but at least you would have two voting members of congress in the Senate and a least one representative. And a governor to go to the U.S. to waste time in all their conventions.

As for the “acts” themselves; unjust, unfair, and destructive to the middle class and poor in P.R. who will not be able to compete with the multi-nationals but will be burdened with high local taxes (I guess that is just about what you already said).

This is a great post, Cassie, and very thought provoking. I think you hit on some very good points and I look forward to more of the discussion.

Adolfo, ugh, it’s just so frustrating. The whole thing. The paternalism, the colonialism, the racism. The looking for solutions from outside because inside is not enough and will never be enough if we don’t build it up! And the more I learn about the way the US bullies countries (and territories!), the more it just makes me upset. The analogy of the pole dancer is a good one, except I would liken it more to a slightly older profession -done against Puerto Rico’s own will.

I agree with all of the changes you suggest. And as for incentive programs like this one, they should at the very least be amended to allow Puerto Rican long-time residents to benefit as well if they decide to open a new export business or investment program. There should be steep penalties for anyone who leaves before a given period including paying back the tax benefits that they reaped. There should be incentive programs for college grads to stay and start businesses or work in non-profit orgs in PR instead of the brain drain to the states. There are so many other things we could do besides turn these old tricks.

And we most certainly need a better voice! Whether that is in the form of statehood or amending the laws so that we have some voting members of congress for the territories I don’t know. But certainly this pushing around of Puerto Rico by the rich needs to stop and we need a better way.

Kevin, thanks for your comment. I am sure that individuals love these incentives. No one is disputing that. And while there are some slight economic benefits when people come and buy stuff or rent a place while they make money, it is not a long term solution if they have not truly put down roots in the community. It is more like a slightly longer-term tourism (and classic failed Reaganomics). For people that benefit enough that a tax break can have you move your entire life here (at least on paper), you are probably “rich” at least in comparison to the average Puerto Rican. Thanks for being part of the conversation for solutions. It takes us all! Income and opportunity inequality is a big topic!

Annie and Barbara, thanks for your comments too! It’s a tough one. It is really interesting looking at this from within. A program like this would have been blasted in Colorado if only people who were NOT from Colorado could benefit from basically ZERO taxes, but here it is like, “Hey, we got screwed again. But maybe they’ll drop a little change from their pockets on the way out.”

i am *delighted* to see this post and commentary here on Life Transplant. thank you, britton and cassie!

The whole thing. The paternalism, the colonialism, the racism.

Those are the reasons is why I left.

Can’t return to a place where you are set up for failure. And even when you do succeed, why return to a dangerous place? I’d rather take my chances in the US mainland. At least I can find a job there. And have the right to vote.

Trickle down economics is BS.

Had to compete with 30 other people for a job at McDonalds in PR. That is what those acts want: to make more people desperate to serve the rich.

Hi There! So I’m certainly not an expert at any of these laws..or any kind of economist, but after reading this post I was curious about the eligibility for local residents.

Act 22 – (Law to Encourage the Transfer of Investors to Puerto Rico) – This does appear to exclude local Puerto Rico residents as it is directed at bringing in New Investors by protecting their earnings from higher taxes…. overall an industry I’m not very familiar with but it would seem that it could create an unfair playing field for local investors.

Act 20 – (Law to Promote the Export of Service) – so for this Act I do not see where it would exclude local residents or am I missing that?

Hi C#, While I don’t fully understand all of the specifics of eligibility that is a good question on Act 20. It does appear that it excludes existing businesses in Puerto Rico while allowing any existing businesses from the states. So it is at the very least lop-sided.

Of course if that isn’t the case great! Make no mistake however, it is a “tax haven” for the wealthy. It is pretty clearly spelled out as such.

As an example, I met someone who was hired by a US based wealthy investor taking advantage of the tax haven laws. He hired 3 guys and saved over $250k/yr on his taxes (after paying the employees a PR wage) by being in Puerto Rico on paper. Yeah, it brought some “jobs” but it is more about a tax haven than spurring the economy. They don’t do anything, they have no products and as far as I can tell it is a “consulting” business where the employees have little to no actual knowledge of the industry they are supposed to be offering consulting services for. They also do not offer any services in PR.

Yes, and don’t forget that they are Export Services only. So that means they can’t actually sell to Puerto Rico! Another huge and ridiculous inequality that should be amended so that the manufacture and sale can be Puerto Rico based as well.

Yes that is ridiculous. I don’t understand why someone can take advantage of these laws and not provide their services to PR residents. I wonder, exactly, what that part of the law was supposed topachieve…

Kevin – if I understand it correctly the goal of the law was to do what places like India did with bringing in large call centers which pulled $ out of the US economy and into their own. Selling services to locally to PR is just shifting the same $ internally in PR.

Digging around a bit It also looks like there have been some amendments to these acts so hopefully they will continue to refine them to make them fair and better overall for PR:

– Senate Bill 864 increases the power of Act 22 to attract wealthy investors by reducing to six years, from 15, the amount of time an individual can’t have lived in Puerto Rico to qualify for its benefits, while also exempting investors who decide to move here from the island’s rigid inheritance laws.

– Senate Bill 1020 expands the type of businesses and services eligible to take advantage of Act 20, as well as other incentives available under Act 73 of 2008, including trading companies, certain marketing services, distribution and logistics, assembly, and bottling and management services.

These Bills don’t solve the overall issues with these acts, but at least they are doing something about expanding / leveling them out. Honestly if we wait for any Government to fix problems we will all be waiting a long time…

I don’t live in PR, but I’m hoping to in the next year so I only have an outsiders view, but I do have a genuine interest to see the island progress and get out of the economic rut it has been in.

I had originally planned to “early retire” when we come down as I’ve been envious reading this blog and watching Britton and Cassie run around chasing chickens and turkeys in the sun! 🙂 I still have a few good years ahead of me and to be honest if I felt like starting a business again I would take advantage of Act 20 and it would have a large impact on my decision to do so. So it has me thinking…maybe semi-retire…

I’m a small business owner here in the states and have sacrificed a lot to get to where I am today. I have slugged it out for many years paying LOTS of US taxes and dealing with all the regulations that make it hard to operate a small business. By using this ACT I could run a services company with a savings of more than 30% on taxes. That would go a long way to making mine and my families lives better and it would also allow me to hire more employees or pay more while still maintaining a healthy and profitable company.

If I did start up a small business I know it would only be a small dent in the overall economic issues but for someone who does care about the island I’d be happy knowing I made a dent and hopefully a bigger impact for those that work with me.

Of course there will always be people that take advantage of laws like this as Britton mentioned. Hopefully the audit processes and paperwork required to maintain the tax breaks will weed those people out and keep legitimate businesses in place that do help the local economy.

One point I would like to make is that there is a tendency for people to turn the wealthy/successful people into villains. That is one point I’m not a fan of. I don’t think successful people should be punished for their success especially if their success was accomplished in an ethical way. I have also seen a lot of not so successful people take advantage of “the system” that government establishes like those that falsely stay on disability or welfare.

In a couple of weeks we will be down in Rincon looking for our place, if I see Britton and Cassey walking down the road I’d be the guy giving them a high five and congratulating them on their success. They deserve it just as anyone does who works hard for what they want.

Thanks C# for doing more investigations into this. And Bienvenidos a Puerto Rico! One thing I can hope with more people moving from the states is that it will shed light on the economic and political inequality that is found here and we need more people like you as part of the solution. Thank you for caring about Puerto Rico and wanting the best not only for you but for society as a whole. I look forward to that high five and maybe more dialogue with you! 🙂

Oh and Kevin, I just checked out your blog. Very nice. Keep it up!

As someone who has moved here largely because of Act 22, maybe I can add a few tidbits to the discussion. Here are a couple of the main concerns I’m seeing:

– They don’t apply to the locals.

Let me clarify a little before I respond. Anyone can apply for Act 20 benefits, even longtime residents.

Also as C# mentioned, they expanded eligibility for Act 22 to allow those that that lived here between 1997 and 2005 to now apply for it.

Having said all that, I agree! EVERYONE in each taxing jurisdiction should be treated equally.

However, I can understand why it wasn’t done that way. The capital gains taxes of nonresidents was not revenue the Puerto Rican government was going to receive anyway. It was budget neutral for them to “give” that away. However, eliminating the capital gains taxes of current residents would cut in to the amount of revenue an already cash strapped government was taking in. Not going to happen.

– It only applies to the rich.

There is no income requirement to apply for Act 22. Back when I applied for it, it only cost $50! Now I understand they are charging $5000 to apply!

I’m just a middle class guy. Much more mustachian than a Henry Paulson type. Taxes are like any other expense. I try to reduce them as much as possible so I don’t HAVE to make a lot of money.

I was originally looking to escape the rat race and move to Panama with my family before we found out about Act 22. I’m so thankful that this incentive put this wonderful island on our radar. We love it here. We are putting roots down here, not just staying 183 days a year. 🙂

Wow, $5,000 just to apply! I wonder what the intent was in making that specific change. To prevent certain people from applying, to cover the cost of administration or simply to get in on more revenue from those taking advantage of the deal? That is a steep price of entry!

Also, thanks for confirming some of what we suspected about the Acts in regards to limiting eligibility and its intent and providing information on the changes. While there is no income requirement the incentive is for people outside of PR who have income (the higher the more incentive one would have) to take advantage of the legalized tax evasion (aka tax haven). The people who take advantage of this are totally doing the right thing for themselves and if I were still investment minded I would too! Don’t get me wrong, this is good for the individuals.

The acts are working as intended there is no doubt, it is the intent that is in question in regards to long lasting economic policy.

Questions to people that moved here would be, did you purchase a property or are you renting? If the act went away would you continue to live here?

I had no idea that the price was $5,000. That is pure insanity. But, all the same, our quarterly tax payments are more than $5,000 here in Arkansas, so it will pay off for us after the first quarter. Still, that fee really is going to make it tight immediately after our move, considering all of the other things that we’ll need to buy (Car, beds, etc..)

As for renting vs buying – We, for one, are renting for 6 months to make sure we like living in PR in general, and to make sure that we find a specific area that we want to live in permanently. At that point, we’ll be buying. If the act went away, we’d stay. We’re not moving BECAUSE of the tax incentives. We’re moving because we want to. The tax incentives are a nice bonus.

One of the folks over at the2022actsociety.org was nice enough to send this to me this morning. It has additional information on Act20 Export Services. Grab some espresso…its a riveting read…

http://www2.pr.gov/agencias/oeci/Documents/Leyes%20y%20Reglamentos/ReglamentoNum8313_REGLAMENTO_LEY_NUM_20_2012.pdf

I also posed the question:

“I think where a lot of the confusion comes in when reading up on these is that many articles online lump Act 20 and 22 together and speak in general terms. It especially seems to reflect that both Acts only apply to New Residents coming to the island. So far what I’m seeing is that is true with Act 22 trying to bring new investors in, but Act 20 can be used by any resident new or existing to start an export service. Would you agree with that based on

your knowledge?”

Their response:

“Yes, your statement is totally accurate; actually most people are not aware that benefits under the Acts are made available separately. You don’t need to be a 22 in order to be a 20, and vice versa.”

So at least Act20 is available to any resident which does make it fair and its nice to know I have the option after settling in for a year or so to start up something focused on export IT services…..Britton – ready to get back to work??? 🙂